Can Your Workforce Investments Grow Enterprise Value?

There’s never been more information available about your business. When every department has a suite of databases, bespoke modeling tools, and in-house analysts, decision-making should be faster and more accurate than in the past.

Yet even data-driven CHROs and CFOs face the same age-old workforce planning question:

“How can we optimize our company’s largest cost without jeopardizing future potential?”

Do you trim administrative roles, reduce workforce in under-performing markets, or offload customer service roles to lower-cost global centers? What if you’ve already done all of that?

Shareholders expect predictable growth

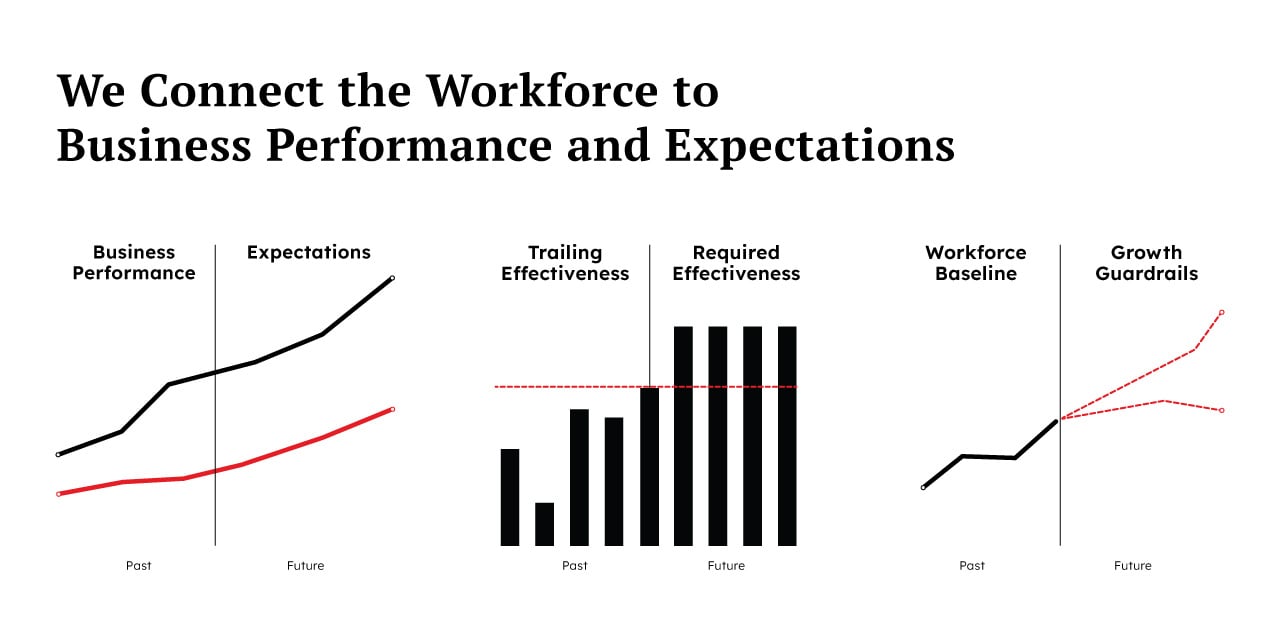

The real challenge for HR and Finance teams is balancing workforce investments and cost reductions against long-term business planning.

Consider the global retail fashion market, which is growing rapidly. Legacy fashion brands have struggled through recent seasons. Micro-brands and emerging designers are cutting through traditional retail channels and delivering directly to consumers, while Gen-Z and Millennials face economic headwinds.

For established brands this means highly volatile customer segments, growth plateaus, and a need to constantly innovate.

While the product team might feel these pressures, it’s the HR and Finance teams who are directly responsible for meeting the challenge. Data and communication silos between these departments can undermine their impact, leading to short-term transactional decision-making.

When enterprise goals are missed the impact can shatter shareholder confidence and put the C-Suite in the hot seat.

Discover Your Workforce Growth Guardrails

If you’re not growing in a growing market, having the right data can show you why.

A more integrated analysis goes beyond revenue and cost data and puts your business in a broader context:

- Are you meeting or exceeding expectations?

- Can emerging technology improve overall efficiency?

- What is the required return on workforce investments?

- How are you performing vs. peers?

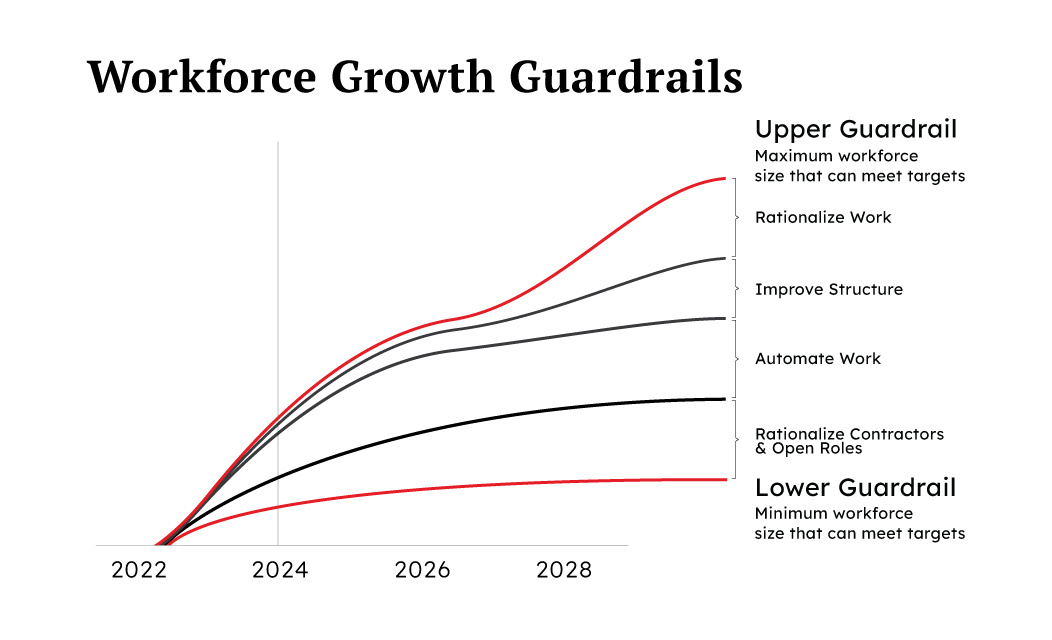

By integrating data and asking the right questions, you can find your Workforce Growth Guardrails: the minimum and maximum investments you can make in your workforce without risking growth and diminishing Enterprise Value.

Simply put: Workforce Growth Guardrails define the workforce investments that will enable you to meet your goals. If you’re outside of these limits, your business is at risk.

It's between these guardrails that we uncover growth engines in your workforce. This is where you can find the spectrum of workforce levers and begin to see their potential impacts.

- Upper Guardrail: The maximum workforce size and cost that can meet expectations without missing targets. As workforce costs approach this line, the risk of underperformance increases.

- Lower Guardrail: The minimum workforce size and cost that support growth expectations. Operating near this line can mean high efficiency, but it may also create additional risk if the model is too fragile.

Aligned Leadership Teams Create Enterprise Value

One luxury athletic apparel brand experienced massive growth from 2020-2023, until the post-pandemic slump. A looming growth plateau coupled with the need to invest in Asia raised concerns for shareholders.

Traditional HR leadership might be fixated on questions like should we cut staffing and from where? Can we augment it with technology or outsource? How many people do we need to grow?

This company's Chief People Officer saw it through another, more comprehensive lens: how can we run the North American office at maximum efficiency and self-fund growth in Asia?

The proposal was simple: Let’s align all of our data across finance, HR, and transformation - and decide what market forces matter. Then we can craft a well-informed plan.

Read the Case Study: Unlocking $1B in Enterprise Value for a Premium Athletic Apparel Brand

Does the CHRO Have a Seat at the Table?

HR leadership can bring incredible strategic value to business planning, beyond executing reductions or planning staffing. While many CEOs and CFOs might be tightly aligned around operational truths, they are often focused on the bottom-line, not on complex solutions and optionality. Uniting with partners across transformation brings even more opportunity to innovate.

|

|

|

Keep HR, Finance, and Transformation separate |

Don’t let “traditional” roles define their collaborators |

|

HR & Finance don't collaborate on workforce investments |

Positions HR as a highly-valued role in organizational decision-making |

|

Move slowly, due to data gaps or annual planning cycles |

Review and update data regularly to answer questions proactively |

|

Focus on technology-led transformation, not workforce transformation |

Make investments in the right growth segments for their business |

|

Rely on expensive, costly consultants |

Build internal expertise and embrace company-first solutions |

Decide Faster, Confidently

Why outsource strategy when your team can own it?

Typical large companies might bring in a trusted consultant who can process their data and speak to broad market forces to recommend “tried and true” solutions for the brand. This process can take months and not every organization is prepared to bring them back regularly as the market evolves.

We strongly feel that P&L teams need the tools to be able to make informed company decisions about how to increase business performance so transformation can happen at the point of anticipated need. When you can test your theories in-house, new ways of thinking about the potential benefits and expected return on workforce investments – e.g. Generative AI – and adjustments to the workforce – e.g. cost optimizations – can surface.

Workforce transformation is a holistic process that affects the full organization, and solutions are no longer limited to implementing automation, reducing headcount, or outsourcing to less expensive cost centers.

Our philosophy: Be approximately right, not precisely wrong. Revenue and earnings are expected to grow alongside record-high operating efficiency, which requires record-high workforce effectiveness. To effectively steer your organization, you need timely information.

- What economic contribution is required of each position to meet growth expectations?

- How can automation supplement our current team instead of direct headcount increases?

- Are we suffering from too much role overlap? What would defragmentation do to total headcount?

- Is your Organizational Development model working or do we need to compress subordinate roles?

- What would happen if we reinvested our savings into a specific team?

The right data helps you to be confident in projecting outcomes.

The right interpretation by your team ensures that you can meet expectations.

Long-Term Planning Combined with Quick Wins

The biggest single question we answer for our partners is: Do you have a workforce that will enable you to meet your targets?

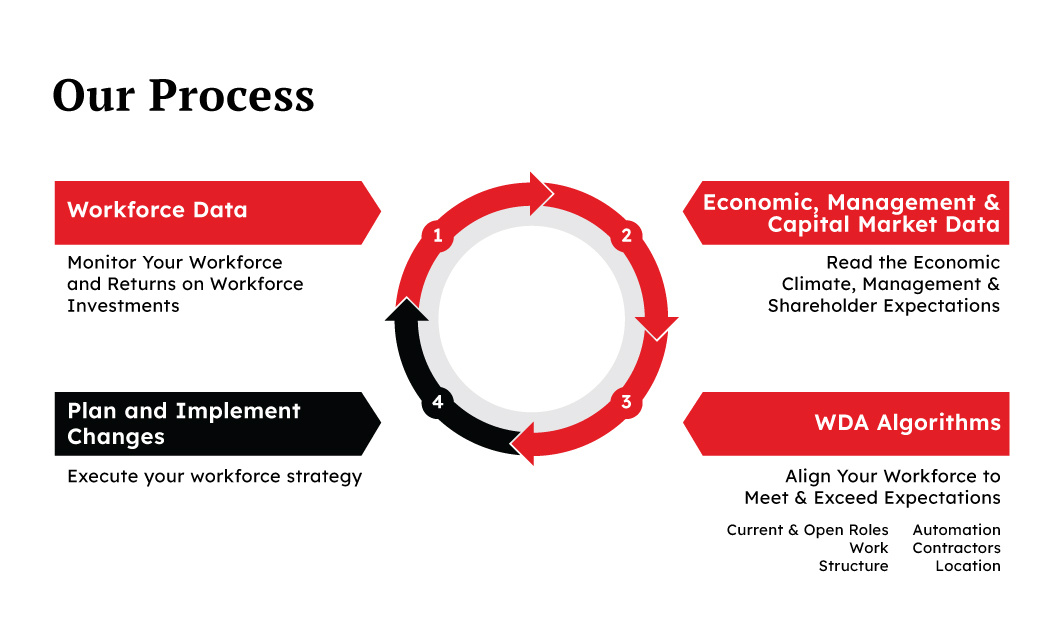

We do this by identifying and joining data from myriad sources in a process that takes just a few weeks to map data to your unique business concerns.

There are two main categories of data to consider in your planning:

- Finding the Money: Where are you spending unnecessarily and where could you save?

- Competitive Comparison: What is the industry and broader marketing telling you?

For an integrated P&L team, this first analysis becomes the foundation of an ongoing model that can be revisited throughout the fiscal year to understand:

- Did you get the benefits or savings you expected from key actions?

- Have you been able to keep savings in the business or have costs crept back up?

- What new opportunities have emerged to increase effectiveness?

Comprehensive solutions correct point-in-time staffing problems while identifying evergreen opportunities to reinvest or grow. The right data, applied through the Workforce Growth Guardrails model, will empower you to identify and address your biggest workforce challenges for lasting transformation.

About WDA

We’ve helped uncover $100M+ potential savings for Fortune 500 companies across highly competitive industries from fashion to banking to insurance. We provide the data and insights; your team makes the big decisions.

Our data models:

- Don't require costly overhead resources to manage or understand

- Deliver insights faster than consultancies

- Adapt to evolving business goals and anticipate future opportunities

- Enable teams to kill departmental data silos

- Uncover comprehensive workforce solutions, including where to reduce costs, build efficiency, increase Enterprise Value, and reinvest savings